UP Ration Card 2022 – 2023 | UP Ration Card List 2022 – 2023 | UP Ration Card 2021 | UP Ration Card 2021 Online | UP Ration Card Online Apply | Ration Card 2021 Ka | Ration Card 2021 Apply | UP Ration Card Online | Online Ration Card Apply UP | Ration Card UP Online Apply | UP Ration Card Website | up ration card challan | fcs.up.nic.in challan download

Important Note – अगर आपके पास राशन कार्ड है, तो आपको मिलेंगे 3 फ्री गैस सिलेंडर, जानिए कैसे..

Ration Card UP : दोस्तों यह तो आप सभी को पता है कि यूपी राशन कार्ड एक बहुत ही महत्वपूर्ण दस्तावेज है और यह प्रत्येक नागरिक के पास होना कितना आवश्यक है| उत्तर प्रदेश सरकार के माध्यम से दी जाने वाली सब्सिडी वाले राशन को राशन कार्ड के माध्यम से आसानी से सस्ती दरों पर प्राप्त कर सकते हैं और इसके साथ ही कई योजनाओं का लाभ लेने के लिए भी UP Ration Card को दस्तावेज के रूप में प्रयोग कर सकते हैं|

दोस्तों अब आप Ration Card UP के लिए घर बैठे ही ऑनलाइन प्रणाली के माध्यम से एप्लीकेशन फॉर्म भर सकते हैं। आज हम आपको यूपी राशन कार्ड से संबंधित जानकारी प्रदान करेंगे कृपया आप हमारे आर्टिकल को अंत तक पढ़े|

Latest Update – आप सभी को सूचित किया जाता है कि राशन कार्ड के नामांकन जारी कर दिए गए हैं। आप अब राशन कार्ड के लिए जल्द से जल्द आवेदन कर दें, जिससे कि आपको योजना का पूरा लाभ मिल सके। राशन कार्ड उत्तर प्रदेश fcs.up.gov.in 2022 – 2023 से जुड़ी हुई छोटी से छोटी अपडेट के लिए हमारी वेबसाइट से जुड़े रहिये।

- up ration card challan

- up ration card download

- up ration card status

- up ration card helpline number

- up ration card list

- up ration card name add

- fcs.up.nic.in challan download | fcs.up.gov.in 2023 challan

- ration card surrender update

- Ration Card New Rules

- E shram card

Table of Contents

NFSA UP Ration Card New Update –अब सितम्बर तक मिलेगा मुफ्त राशन सरकार ने किया नया ऐलान

मुफ्त राशन योजना उत्तर प्रदेश : यूपी सरकार द्वारा गरीबों को मुफ्त राशन प्रदान किया जा रहा था जिसे लेकर सरकार ने एक नया ऐलान किया है। अब यूपी सरकार द्वारा गरीबों को अग्रिम तीन महीने तक मुफ्त में राशन प्रदान किया जायेगा। दोस्तों राज्य सरकार ने हाल ही में ये घोषणा की है। अतः अब गरीबों को जून 2022 – 2023 से सितम्बर 2022 – 2023 तक मिलेगा मुफ्त में राशन

दोस्तों आपको बता दें कि मुफ्त राशन योजना उत्तर प्रदेश, प्रधानमंत्री गरीब कल्याण योजना के तेहत चलायी जा रही है। जिसका लाभ उत्तर प्रदेश के सभी गरीब नागरिकों को प्राप्त होगा।

PAN Card धारकों के लिए जरूरी सूचना : PAN Card को Aadhar Card से लिंक कराने की अंतिम तारीख 31 मार्च 2023 है। जिन लोगो ने अभी तक अपने PAN Card को Aadhar Card से लिंक नहीं कराया है वह जल्द से जल्द अपना पैन कार्ड लिंक करा लें अन्यथा आपका पैन कार्ड मान्य नहीं होगा। PAN Card Aadhar Link के लिए – यहाँ क्लिक करें

आधार नंबर से राशन कार्ड कैसे डाउनलोड करें – जानने के लिए यहाँ क्लिक करें

UP Ration Card NFSA | उत्तर प्रदेश राशन कार्ड ऑनलाइन

राशन कार्ड देशवासियों की आर्थिक स्थिति को मध्य नजर रखते हुए अलग-अलग श्रेणियों वाले नागरिकों को अलग-अलग श्रेणी के राशन कार्ड जारी किए जाते हैं | अलग-अलग राशन कार्ड की श्रेणियां जैसे APL, BPL, AAY कार्ड जारी किये जाते हैं। यूपी राशन कार्ड के माध्यम से राशन कार्ड धारक सरकार द्वारा सब्सिडी दरों पर जारी किए जाने वाले राशन का लाभ उठा सकते हैं| राशन कार्ड धारक प्रत्येक महीने UP Ration Card NFSA के माध्यम से दाल, गेहूँ, चाँवल, चीनी, कैरोसीन आदि जैसी खाद्य वस्तुएँ सस्ती दरों पर प्राप्त कर सकते हैं इसके लिए सरकार ने राशन की दुकानों को निश्चित किया हैं।

Note – ग्रामीण क्षेत्रों में रहने वाले नागरिकों को काम देने के लिए ग्रामीण रोजगार गारंटी अधिनियम पारित किया है। दोस्तों यह अधिनियम राष्ट्रीय स्तर पर है और इस अधिनियम का नाम नरेगा है। इस योजना के तहत नागरिकों का नरेगा जॉब कार्ड बनाया जाएगा |

Key Highlights Of Ration Card Online UP

| आर्टिकल | यूपी राशन कार्ड ऑनलाइन आवेदन |

| सम्बंधित विभाग | खाद्य एवं रसद विभाग |

| साल | 2022-2023 |

| केटेगरी | UP Ration Card NFSA |

| आवेदन प्रक्रिया | ऑनलाइन/ऑफलाइन दोनों |

| लाभार्थी | देश के नागरिक |

| उद्देश्य | नागरिकों को सब्सिडी दामों में राशन प्रदान करवाना |

| UP Ration Card Website | Click Here |

यूपी राशन कार्ड के प्रकार

सरकार नागरिकों की आर्थिक स्थिति के अनुसार उन्हें अलग-अलग श्रेणियों के राशन कार्ड जारी करती है जिसके माध्यम से परिवार राशन प्राप्त कर सकते हैं।

APL (Above Poverty Line) :

देश के गरीबी रेखा से ऊपर जीवन यापन करने वाले आवेदकों को एपीएल राशन कार्ड जारी किया जाता है इस राशन कार्ड के द्वारा राशन कार्ड धारक प्रत्येक महीने राशन की दुकान से 15 किलो राशन प्राप्त कर सकता है I

BPL (Below Poverty Line) :

देश के गरीबी रेखा से नीचे जीवन यापन करने वाले परिवारों को बीपीएल राशन कार्ड जारी किया जाता है इस राशन कार्ड के माध्यम से नागरिक 25 किलो राशन प्राप्त कर सकता है यह राशन कार्ड केवल उन्हीं परिवारों को दिया जाता है उनकी सालाना आय ₹10000 से कम होती है I

AAY (Antodaya Anna Yojana) :

एएवाई राशन कार्ड उन नागरिकों के लिए जारी किया जाता है जिनकी आर्थिक स्थिति बहुत ज्यादा कमजोर होती है उनके परिवार में कोई कमाने वाला व्यक्ति नहीं होता है ऐसे परिवारों को एएवाई राशन कार्ड जारी किया जाता है इस राशन कार्ड के माध्यम से परिवार 35 किलो राशन सस्ती दर पर प्राप्त कर सकता है I

यूपी राशन कार्ड ऑनलाइन का उद्देश्य – UP Ration Card List

उत्तर प्रदेश राशन कार्ड को जारी करने का मुख्य उद्देश्य देश के नागरिकों को सस्ती दरों पर राशन उपलब्ध कराना है| यूपी राशन कार्ड के माध्यम से नागरिकों को काफी सहायता मिलती है इस दस्तावेज को बनवाने के लिए आम नागरिकों को कहीं जाने की आवश्यकता नहीं है| अब ऑनलाइन पोर्टल के माध्यम से आवेदक कहीं से भी UP Ration Card Online आवेदन कर सकते हैं| इससे आवेदकों के समय और पैसे दोनों की बचत होगी|

PM Kisan eKYC ऑनलाइन कैसे करें – जानने के लिए यहाँ क्लिक करें

यूपी राशन कार्ड के माध्यम से नागरिक प्रत्येक महीने सब्सिडी दरों पर राशन की दुकानों से राशन प्राप्त कर सकते हैं और कई सरकारी योजनाओं और विद्यार्थियों के लिए भी राशन कार्ड महत्वपूर्ण होता है| विद्यार्थी उत्तर प्रदेश राशन कार्ड के माध्यम से छात्रवृत्ति प्राप्त कर सकते हैं, Ration Card UP को दस्तावेज के रूप में प्रयोग किया जाता है|

- यूपी राशन कार्ड लिस्ट 2022 – 2023

- यूपी राशन कार्ड चेक कैसे करें

- यूपी राशन कार्ड हेल्पलाइन नंबर

- यूपी राशन कार्ड कैसे खोजें

- यूपी राशन कार्ड कैसे देखें

- Nrega Job Card

उत्तर प्रदेश राशन कार्ड योजना के अंतर्गत खाद्य पदार्थों का मूल्य

| Cereal Name | Price |

| Wheat | Rs.2 per kg |

| Rice | Rs.3 per kg |

| Sugar | Rs.13.50 per kg |

Aadhar Card Se Loan Kaise Le – जानने के लिए यहाँ क्लिक करें

UP Ration Card 2022 – 2023– Data

| Total Antyodaya card | 4091279 |

| Total Antyodaya Beneficiary | 12837114 |

| Total eligible household cards | 31710750 |

| Total eligible household beneficiary | 125983531 |

UP Ration Card Online आवेदन 2022 – 2023 की पात्रता – Eligibility Criteria | fcs up gov in | fcs.up.gov.in 2022

Ration Card Online UP के लिए आवेदक को नीचे दी गई पात्रता को पूरा करना आवश्यक है इसकी जानकारी कुछ इस प्रकार हैं।

- राशन कार्ड बनवाने के लिए आवेदक को भारत का नागरिक होना अनिवार्य है ।

- Ration Card UP के लिए एप्लीकेशन फॉर्म भरने के लिए सभी जरूरी दस्तावेज जैसे कि आपका आधार कार्ड होना आवश्यक है।

- उम्मीदवार की आयु 18 वर्ष से अधिक होने आवश्यक है

- बीपीएल राशन कार्ड बनवाने के लिए आवेदक को गरीबी रेखा से नीचे जीवन यापन करने वाला होना चाहिए।

उत्तर प्रदेश राशन कार्ड में आवेदन के लिए आवश्यक दस्तावेज – Required Documents | FCS UP | fcs.up.gov.in 2022 – 2023

- निवास प्रमाण पत्र (Address Proof)

- पत्र व्यवहार का पता

- आय प्रमाण पत्र (Income Certificate)

- मोबाइल नंबर

- परिवार के सदस्यों का आधारकार्ड

- पासपोर्ट साइज फोटोग्राफ

UP Ration Card – Statistics | FCS | fcs.up.gov.in 2022 – 2023

| कुल एनएफएसए कार्ड | 34102564 |

| लाभार्थी | 149963629 |

| कुल PHH कार्ड | 30007971 |

| लाभार्थी | 133678317 |

| कुल AAY कार्ड | 4094593 |

| लाभार्थी | 16285312 |

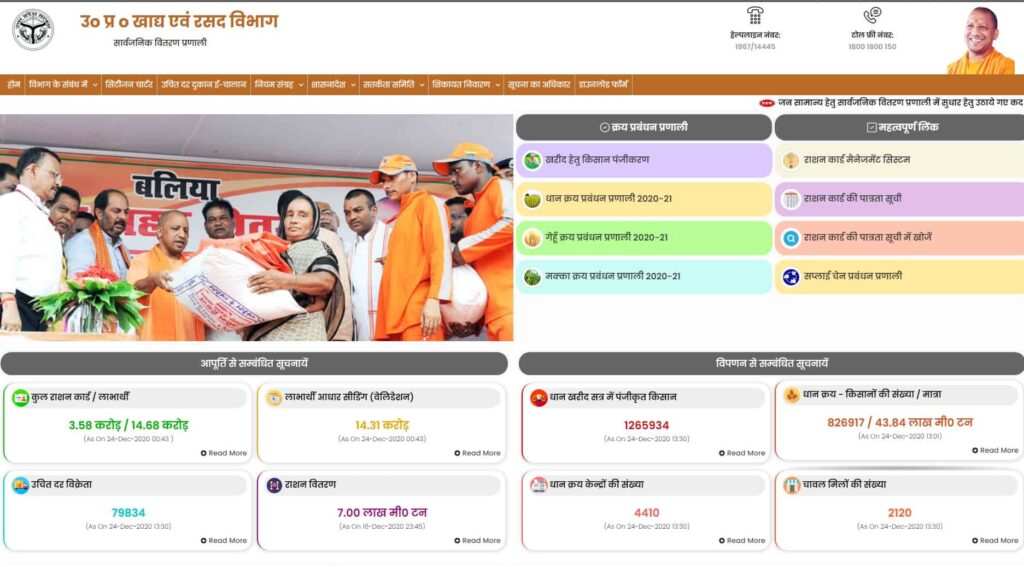

fcs.up.gov.in 2022 – 2023 Portal से यूपी राशन कार्ड ऑनलाइन कैसे बनवाएं – UP FCS Ration Card Online Apply

UP FCS Ration Card Online Apply : दोस्तों आप घर बैठे ही बहुत ही आसान चरणों को फॉलो करके ऑनलाइन माध्यम से राशन कार्ड को बनवा सकते हैं और इसके लिए ऑनलाइन आवेदन फॉर्म भर सकते हैं| आप नीचे दिए गए समस्त चरणों को फॉलो करके अपने राशन कार्ड ऑनलाइन अप्लाई कर सकते हैं –

Step 1 :

- सबसे पहले आपको उत्तर प्रदेश की आधिकारिक वेबसाइट की ई-डिस्ट्रिक्ट को अपनी स्क्रीन पर खोल लेना होगा।

- अब वेबसाइट का होम पेज स्क्रीन पर आ जाएगा। यहां स्क्रीन पर आपको लॉगिन का ऑप्शन मिलेगा आपको ऐसा ऑप्शन पर क्लिक कर देना है।

- जैसे ही आप इस ऑप्शन पर क्लिक करेंगे, स्क्रीन पर एक नया पेज खुल जाएगा।

- इसमें आपको ई डिस्टिक लॉगइन फॉर्म देखने को मिल जाएगा।

- अब इस ऑप्शन में आपको CSC/e-District user लिंक को सेलेक्ट कर लेना है व यूजर आईडी और पासवर्ड को दर्ज कर देना है।

- फिर कैप्चा कोड को सही-सही दर्ज करना है और सबमिट के ऑप्शन पर क्लिक कर देना है।

Step 2 :

- जैसे ही आप इस ऑप्शन पर क्लिक करेंगे, आपकी स्क्रीन पर नया पेज खुल जाएगा।

- यहां आपको इंटीग्रेटेड डिपार्टमेंट सर्विस का लिंक दिया जाएगा। आपको इस लिंक पर क्लिक कर देना है। अब स्क्रीन पर एक नया पेज खुल जाएगा।

- इस नए पेज पर आपको Food and Civil Supplies (Ration Card) के ऑप्शन को सेलेक्ट कर लेना है।

- अब स्क्रीन पर खाद्य एवं रसद विभाग का पेज खुल जाएगा। इसमें आपको NFSA के दिए हुए लिंक पर क्लिक कर देना है।

- फिर स्क्रीन पर एन एफ एस ए (NFSA) का मैन्यू खुल जाएगा। यहां आपको कुछ ऑप्शन दिखाई देंगे जैसे कि – राशन की रसीद देखनी, फॉर्म में संशोधन या प्रिंटआउट निकलवाने ,नई पर्विष्टि आदि।

Step 3 :

- अब आपको इनमें से नया प्रविष्टि पात्र गृहस्थी के लिए दिए गए ऑप्शन को सेलेक्ट कर लेना है।

- जैसे ही आप इस ऑप्शन को सिलेक्ट करेंगे, स्क्रीन पर एक नया पेज खुल जाएगा।

- इसमें आपको अपना जिला तथा उस जिले के शहरी/ ग्रामीण क्षेत्र जहाँ भी आप रहते हैं आदि का चयन कर लेना है।

- फिर आपको आगे बढ़े के ऑप्शन पर क्लिक कर देना है। जैसे ही आप इस ऑप्शन पर क्लिक करेंगे, इसके पश्चात आपकी स्क्रीन पर नया पेज खुल जाएगा।

- यहां आपको आय प्रमाण पत्र विवरण के नीचे दिए गए एप्लीकेशन नंबर और सर्टिफिकेट आईडी सही प्रकार से दर्ज कर देना है और आगे बढ़े के ऑप्शन पर क्लिक करना है।

Step 4 :

- अब आपको स्क्रीन पर एक एप्लीकेशन फॉर्म देखने को मिल जाएगा। यहां आपसे पूछी गई जानकारी को सही-सही दर्ज कर देना है।

- जानकारियां सही प्रकार से दर्ज करने के पश्चात आपको उद्घोषणा के ऑप्शन पर क्लिक करना है और सुरक्षित करें के ऑप्शन पर क्लिक कर देना है।

- इसके पश्चात आपको एक ration card number प्राप्त होगा। आपको इसे सुरक्षित करके अपने पास रख लेना है।

Step 5 :

- इसके बाद आपको “एप्लीकेशन फॉर्म प्रिंट करें” के लिंक पर क्लिक करना है।

- इसके बाद आवेदक को राशन कार्ड हेतु पावती रसीद के विकल्प पर जाकर आपको ration card number (जो की आपको प्राप्त हुआ है ) को दर्ज कर देना है।

- राशन कार्ड नंबर को दर्ज करने के पश्चात राशन कार्ड की एक स्क्रीन पर आ जाएगी।

- आपको इसका प्रिंट आउट निकाल लेना है। इस तरह आपका एप्लीकेशन फॉर्म पूर्ण रुप से भर जाएगा और संबंधित वेरिफिकेशन प्रक्रिया पूर्ण होने के पश्चात आप के राशन कार्ड को जारी कर दिया जाएगा।

शार्क टैंक इंडिया क्या है – यहाँ क्लिक करें और जानें

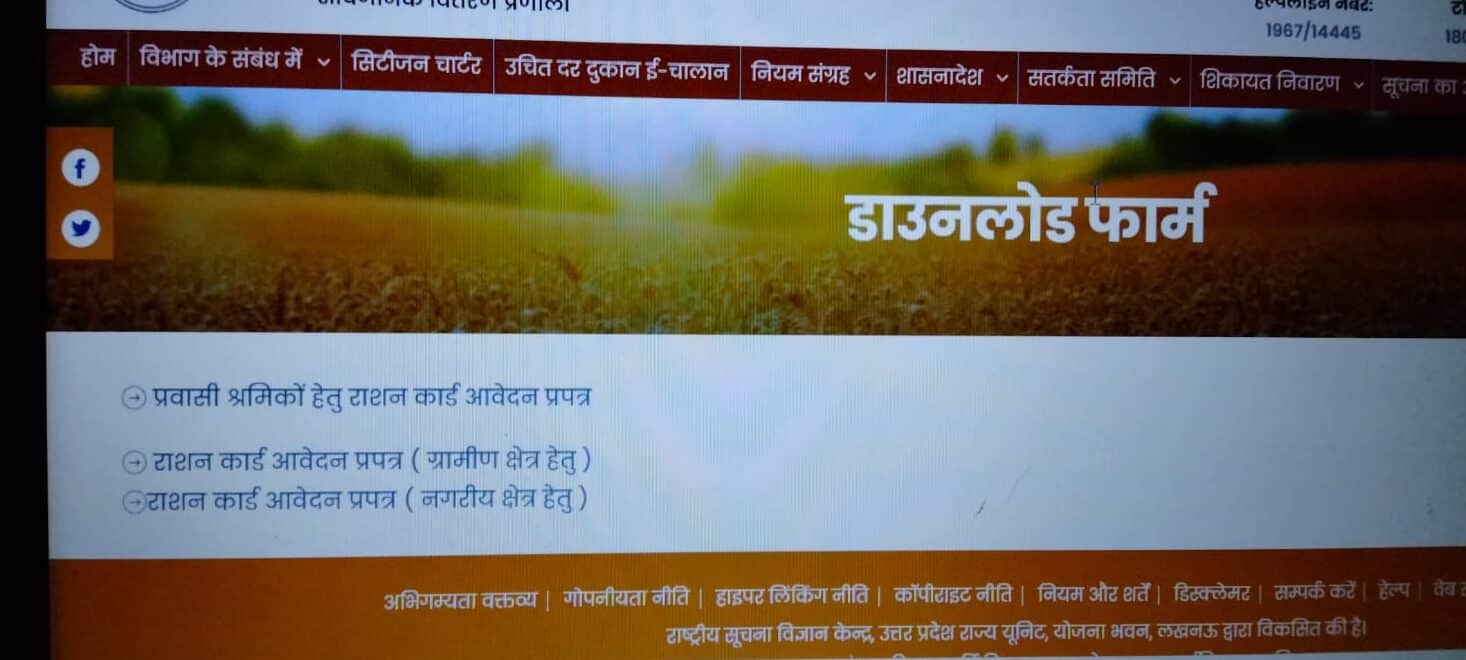

UP Ration Card 2022 – 2023 हेतु ऑफलाइन आवेदन कैसे करें? | UP FCS | fcs.up.gov.in 2022 – 2023

UP Ration Card Apply : उत्तर प्रदेश राशन कार्ड बनवाने के लिए आवेदन हेतु आप इसकी ऑफिशल वेबसाइट पर जा सकते हैं और प्रक्रिया जानने के लिए नीचे दिए गए सभी चरणों को फॉलो करें :

- सर्वप्रथम आपको इसकी ऑफिशल वेबसाइट पर जाना होगा।

- अब वेबसाइट का होम पेज स्क्रीन पर आ जाएगा।

- यहां आपको डाउनलोड फॉर्म का ऑप्शन दिखाई देगा।

- अब आपको इस ऑप्शन पर क्लिक करना है।

- अब नेक्स्ट पेज पर तीन ऑप्शन दिखाई देंगे।

- अगर आप ग्रामीण क्षेत्र से हैं तब आपको राशन कार्ड आवेदन प्रपत्र ( ग्रामीण क्षेत्र हेतु ) के लिए ऑप्शन सेलेक्ट करना होगा।

- अगर आप शहर से हैं तो आपको राशन कार्ड आवेदन प्रपत्र ( नगरीय क्षेत्र हेतु ) ऑप्शन को सिलेक्ट करना होगा।

- इसके पश्चात नेक्स्ट पेज पर एप्लीकेशन फॉर्म ओपन हो जाएगा।

- इस फॉर्म को आप को डाउनलोड कर लेना है।

- जैसे ही फॉर्म डाउनलोड हो जाएगा आपको उसका प्रिंट आउट निकाल लेना है।

- फॉर्म का प्रिंट आउट निकालने के पश्चात इस फॉर्म में पूछी गई समस्त जानकारी जैसे कि मुखिया का नाम, पिता/पति का नाम, बैंक का नाम, मोबाइल नंबर, जिला, ग्राम पंचायत, जन्म तिथि आदि ध्यानपूर्वक दर्ज करनी होगी।

- फिर आपको फॉर्म के साथ मांगे गए सभी दस्तावेजों को अटैच करना होगा।

- फिर आपको फॉर्म ले जाकर तहसील या फिर खाद्य सुरक्षा विभाग के ऑफिस में जमा करना होगा।

- इस प्रकार आपकी एप्लीकेशन प्रक्रिया कंप्लीट हो जाएगी।

- फिर संबंधित अधिकारियों के माध्यम से आप के फॉर्म की पूरी जांच की जाएगी।

- फिर कुछ दिनों के पश्चात आपके Ration Card को जारी कर दिया जाएगा।

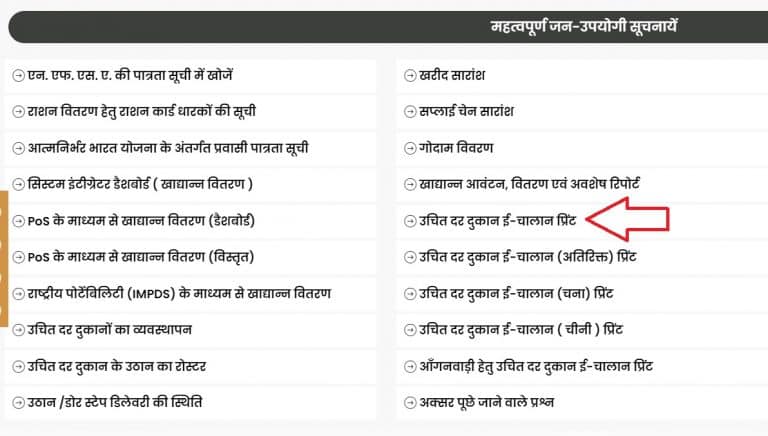

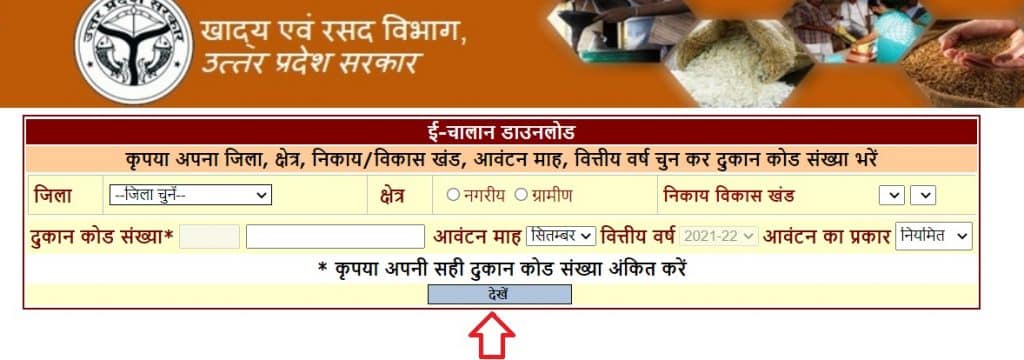

How To Download UP Online Ration Card E Challan – up fcs challan download | Ration e challan

UP Ration Card Challan Download : दोस्तों यदि आप अपने राशन कार्ड के लिए e-challan को डाउनलोड करना चाहते हैं तो आप नीचे बताए गए समस्त दिशानिर्देशों को फॉलो करके अपने यूपी राशन कार्ड चालान डाउनलोड कर सकते हैं। यह दिशानिर्देश कुछ इस प्रकार है :

- यूपी राशन कार्ड ई चालान डाउनलोड करने के लिए आपको सबसे पहले इसकी आधिकारिक वेबसाइट पर जाना होगा।

- आधिकारिक वेबसाइट का लिंक कुछ इस प्रकार है- scm.up.gov.in आप इस लिंक पर क्लिक करके भी इसकी आधिकारिक वेबसाइट पर पहुंच सकते हैं।

- इसके पश्चात वेबसाइट का होम पेज ओपन हो जाएगा।

- फिर वेबसाइट के होम पेज पर आपको कई ऑप्शन दिखाई देंगे।

- आपको इसमें से “उचित दर दुकान ई – चालान प्रिंट” के option पर क्लिक करना होगा।

- उचित दर दुकान ई – चालान प्रिंट” के ऑप्शन पर क्लिक करने के बाद आपके सामने ये फॉर्म / ऑप्शन खुल जायेंगे।

- उसके बाद सबसे पहले आपको इसमें आपको अपने जिले को सेलेक्ट करना होगा।

- फिर आपको केंद्र कहां का है, नगर या फिर ग्रामीण के ऑप्शन में से किसी एक ऑप्शन को सिलेक्ट करना होगा।

- फिर उम्मीदवार को पंजीकृत निकाय विकासखंड को सेलेक्ट करना होगा।

- अब उम्मीदवार को दुकान कोड संख्या और जिस महीने का ई चालान प्राप्त करना है, आपको उस ऑप्शन को सिलेक्ट कर लेना है।

- फिर आवंटन के प्रकार को सेलेक्ट करना है और देखें के ऑप्शन को टच करना है। जैसे ही आप ऐसा करेंगे UP Ration Card Challan Download / यूपी राशन कार्ड ई चालान होकर आपकी डिवाइस में सेव हो जायेगा।

Ration Card Check – यूपी राशन कार्ड चेक कैसे करें – UP Ration Card List 2022 – 2023 कैसे देखें ?

यूपी राशन कार्ड लिस्ट / उत्तर प्रदेश राशन कार्ड 2022 – 2023 की लिस्ट / Ration Card List देखने हेतु कृपया नीचे दिए गये लिंक पर क्लिक कीजिये –

Ration Card List >>>> यहाँ क्लिक करें

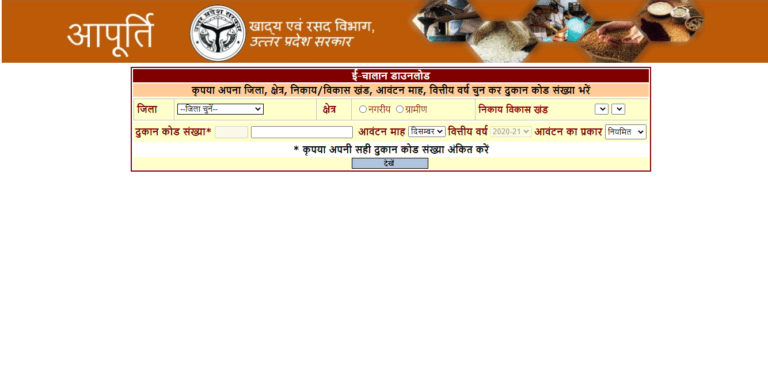

फेयर प्राइस शॉप ई चालान रिपोर्ट देखने की प्रक्रिया – UP Ration Card Challan Report

- दोस्तों आपको सबसे पहले खाद्य एवं रसद विभाग उत्तर प्रदेश की ऑफिशल वेबसाइट को ओपन कर लेना है |

- यहां होम पेज पर आपको उचित दर दुकान ई चालान का एक लिंक दिखाई देगा।

- फिर आपको इस लिंक पर क्लिक करना है।

- इसके पश्चात स्क्रीन पर नया पेज ओपन हो जाएगा।

- यहां आपको अपना जिला क्षेत्र, निकाय, विकासखंड आदि संख्या, आवंटन महा, आवंटन का प्रकार आदि की जानकारी को सही-सही दर्ज करना है।

- फिर व्यू के ऑप्शन पर क्लिक करना है।

- अब UP Ration Card Challan Report से जुड़ी जानकारी आपकी कंप्यूटर या मोबाइल की स्क्रीन पर प्रदर्शित हो जाएगी।

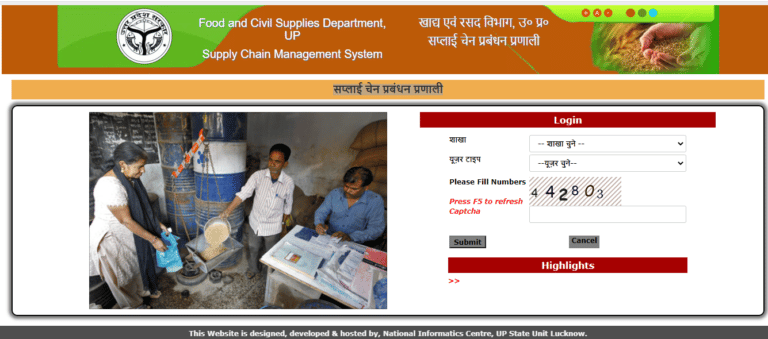

सप्लाई चेन प्रबंधन प्रणाली

- सबसे पहले आपको खाद्य एवं आपूर्ति विभाग की ऑफिशल वेबसाइट पर विजिट करना है।

- अब वेबसाइट का होम पेज स्क्रीन पर आ जाएगा।

- यहां आपको महत्वपूर्ण लिंक के सेक्शन में सप्लाई चैन प्रबंधन प्रणाली का ऑप्शन प्राप्त होगा।

- फिर आपको इस ऑप्शन पर क्लिक करना है।

- जैसे ही आप इस ऑप्शन पर क्लिक करेंगे नेक्स्ट पेज ओपन हो जाएगा।

- यहां आपको लॉग इन करना है।

- लॉग इन करने के लिए आपको अपनी ब्रांच और यूजरटाइप आदि को सेलेक्ट करना है।

- फिर कैप्चा कोड दर्ज करना है और सबमिट के ऑप्शन पर क्लिक करना है।

PoS के माध्यम से खाद्यान्न वितरण कैसे देखे ?

उत्तर प्रदेश के जो नागरिक PoS के माध्यम से खाद्यान्न विवरण की जानकारी लेना चाहते हैं वह नीचे दिए गए सभी चरणों को ध्यान पूर्वक फॉलो करे।

- दोस्तों आपको सबसे पहले खाद्य और आपूर्ति विभाग की ऑफिशल वेबसाइट को अपने कंप्यूटर पर ओपन कर लेना है।

- वेबसाइट के होम पेज पर आपको महत्वपूर्ण व उपयोगी सूचनाओं के सेक्शन में से पीओएस के द्वारा खाद्यान्न वितरण के ऑप्शन पर जाना है और इस पर क्लिक करना है।

- ऑप्शन पर क्लिक करने के बाद नेक्स्ट पेज ओपन हो जाएगा।

- यहां आपको पीओएस के द्वारा खाद्यान्न का पूरा विवरण मिल जाएगा।

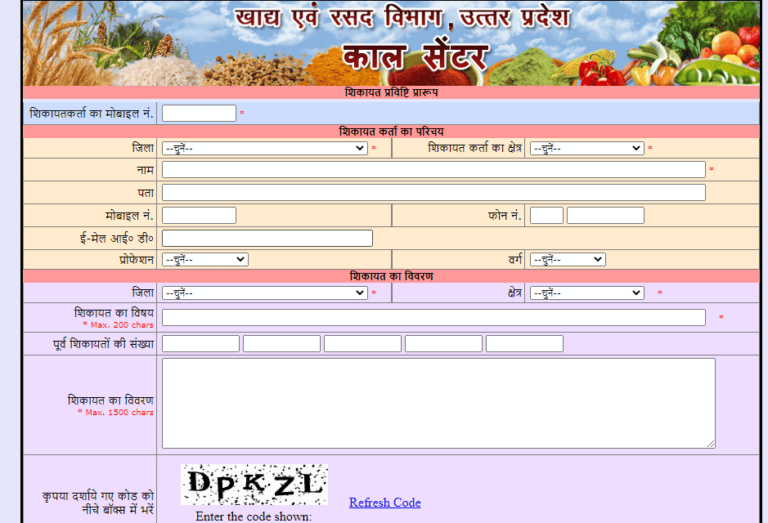

राशन कार्ड ऑनलाइन चेक up | शिकायत दर्ज करने की प्रक्रिया – UP Ration Card Complaint

राशन कार्ड ऑनलाइन चेक उत्तर प्रदेश : अगर आप राशन कार्ड ऑनलाइन चेक up करना चाहते हैं तो इसके लिए आपको अपने द्वारा किये गये आवेदन की स्तिथि की जांच करनी होगी। इसी के माध्यम से आप अपना राशन कार्ड ऑनलाइन चेक up कर सकते हैं। उत्तर प्रदेश राशन कार्ड आवेदन स्तिथि की जाँच करने की प्रक्रिया निम्नलिखित प्रकार है :

- सर्वप्रथम आपको खाद्य एवं रसद विभाग उत्तर प्रदेश की ऑफिशल वेबसाइट पर विजिट करना है |

- अब वेबसाइट का होम पेज स्क्रीन पर ओपन हो जाएगा |

- यहां आपको ऑनलाइन शिकायत करें का एक लिंक दिखाई देगा|

- अब आपको इस लिंक पर क्लिक करना है

- अब स्क्रीन पर नया पेज ओपन हो जाएगा

- फिर शिकायत दर्ज करें का एक लिंक खुलेगा

- यहां आपको शिकायत फॉर्म में पूछी गई सदस्य जानकारी दर्ज करनी होगी|

- जानकारी जैसे कि जिला, नाम, मोबाइल नंबर, ईमेल आईडी, कंप्लेंट डिटेल आदि

- इसके पश्चात एंटर के ऑप्शन पर क्लिक करना होगा

- फिर आप इस तरह से शिकायत दर्ज कर सकते हैं ।

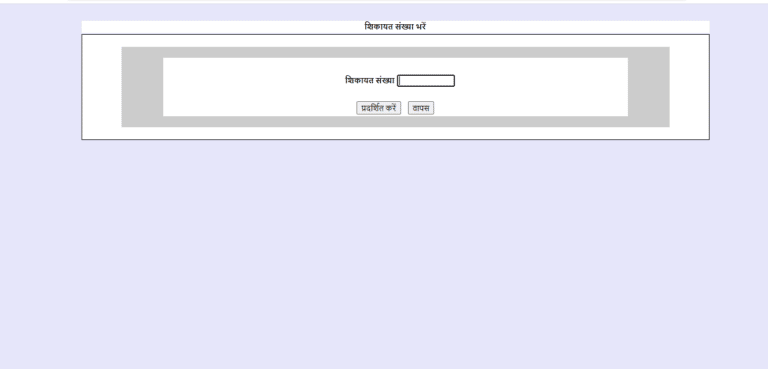

शिकायत की स्थिति देखने की प्रक्रिया – UP Ration Card Complaint Status – Ration Card Status

- दोस्तों Ration Card Status के लिए आपको सबसे पहले उत्तर प्रदेश के खाद्य एवं रसद विभाग की ऑफिशल वेबसाइट पर विजिट करना होगा |

- स्क्रीन पर होम पेज आ जाएगा |

- यहां आपको शिकायत की वर्तमान स्थिति देखे का एक लिंक मिलेगा|

- अब आपको इस लिंक पर क्लिक करना है जैसे अब इस लिंक पर क्लिक करेंगे |

- इस स्क्रीन पर नया पेज खुल जाएगा|

- इसमें आपको अपनी शिकायत संख्या दर्ज करनी है|

- इसके बाद आप को प्रदर्शित करें के लिंक पर क्लिक करना होगा।

- अब आपको यहां पर शिकायत की स्थिति / Ration Card Status देखने को मिल जाएगा|

फीडबैक दर्ज कैसे करें?

- शिकायत दर्ज करने के लिए उम्मीदवारों को सबसे पहले विभाग की आधिकारिक वेबसाइट पर जाना होगा।

- खुले होम पेज में फीडबैक का ऑप्शन दिखाई देगा वहां क्लिक करें।

- फिर आपको पेज में पूछी गयी जानकारियों को दर्ज करना है।

- जानकारी भरने के बाद फॉर्म को सबमिट कर दें।

- अब आपकी फीडबैक दर्ज करने की प्रकिया पूरी हो जाती है।

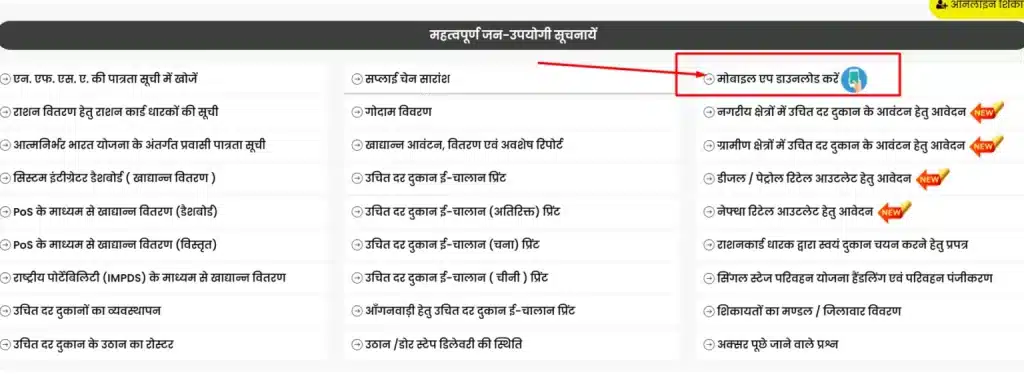

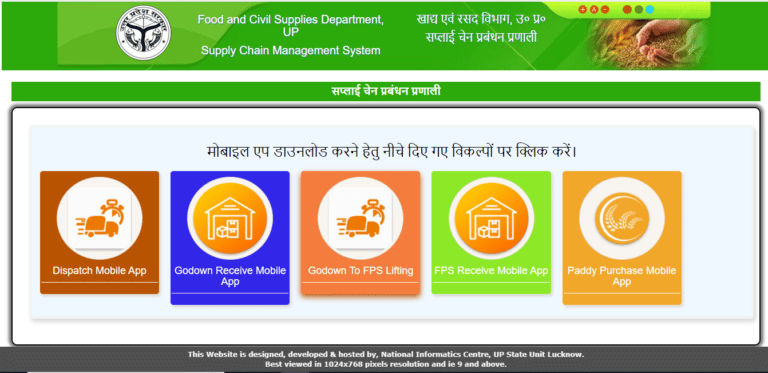

उत्तर प्रदेश राशन कार्ड ऐप कैसे डाउनलोड करें – UP Ration Card App Download

एफसीएस मोबाइल एप्प डाउनलोड कैसे करें – उत्तर प्रदेश राशन कार्ड मोबाइल एप्लीकेशन डाउनलोड करने के लिए आपको नीचे दिए गये स्टेप्स को फॉलो करना होगा। जो कि निम्नलिखित प्रकार हैं –

- सर्वप्रथम आपको खाद्य एवं रसद विभाग की ऑफिशल वेबसाइट पर विजिट करना होगा।

- यहां होम पेज पर आपको महत्वपूर्ण जन-उपयोगी सूचनाएं वाले बॉक्स के अन्दर मोबाइल एप्लीकेशन डाउनलोड करें का एक लिंक मिल जाएगा।

- आपको इस लिंक पर क्लिक करना है।

- जैसे ही आप इस लिंक पर क्लिक करेंगे आपकी स्क्रीन पर UP Ration Card से जुड़े संबंधित मोबाइल App की सूची खुल जाएगी।

- फिर आप जिस भी एप्लीकेशन को डाउनलोड करने की इच्छुक है आपको उस ऐप पर क्लिक कर देना है।

- फिर आपके मोबाइल में UP Ration Card App Download हो जाएगी।

UP Ration Card Download कैसे करें?

यूपी राशन कार्ड डाउनलोड / Ration Card Download करने हेतु नीचे दिए गये लिंक पर क्लिक करें –

Ration Card Download >>>> यहाँ क्लिक करें

UP Ration Card Status कैसे देखें?

यूपी राशन कार्ड स्टेटस / Ration Card Status देखने हेतु नीचे दिए गये लिंक पर क्लिक करें –

Ration Card Status >>>> यहाँ क्लिक करें

UP Ration Card Name Add कैसे करें?

यदि आप यूपी राशन कार्ड में अन्य सदस्यों का नाम जोड़ना चाहते हैं तो आप यह घर बैठे ही आसानी से कर सकते हैं| UP Ration Card Name Add करने हेतु नीचे दिए गये लिंक पर क्लिक करें –

उत्तर प्रदेश राशन कार्ड हेल्पलाइन नंबर

मित्रों हमने आपके साथ यूपी राशन कार्ड से सम्बंधित सभी महत्वपूर्ण जानकारी साझा की है| यदि आप अभी भी उत्तर प्रदेश राशन कार्ड से सम्बंधित किसी भी प्रकार की समस्या का सामना कर रहे हैं तो आप यूपी राशन कार्ड हेल्पलाइन नंबर पर संपर्क कर सकते हैं|

- UP Ration Card Helpline Number : 1967, 1800-180-0150

- UP Ration Card Complaint Number : 47049

fcs.up.gov.in Ration Card List 2022 – 2023 – District Wise

Quick Links :

Ration Card – State Wise Links

NFSA UP Ration Card 2022 – 2023 से सम्बंधित पूछे जाने वाले प्रश्न

उत्तर प्रदेश राशन कार्ड की वेबसाइट क्या है?

उत्तर प्रदेश राशन कार्ड की ऑफिसियल वेबसाइट https://fcs.up.gov.in/ है|

राशन कार्ड हेल्पलाइन नंबर UP क्या है?

उत्तर प्रदेश राशन कार्ड हेल्पलाइन नंबर 1967, 1800-180-0150 है।

अगर राशन न मिलने पर हेल्पलाइन नंबर से कोई जवाब नहीं मिले तो क्या करें?

यदि आपको हमारे द्वारा ऊपर बताये गए राशन कार्ड टोल-फ्री हेल्पलाइन नंबर से कोई जवाब नहीं मिलता है तो आप NFSA Portal में जाकर अपनी शिकायत को ऑनलाइन भी दर्ज करा सकते हो या फिर आप अपने ग्राम प्रधान या वार्ड मेंबर से भी rसम्पर्क कर सकते हैं।

मुख्यमंत्री जी से राशन कार्ड से सम्बंधित शिकायत कैसे करें?

अब उत्तर प्रदेश राज्य के नागरिक मुख्यमंत्री योगी आदित्यनाथ जी से सीधे शिकायत कर सकते हैं| शिकायत करने के लिए आपको टोल फ्री नंबर 1076 पर कॉल करनी होगी| इस नंबर पर कॉल करके सीएम की टीम आपकी सभी प्रकार की शिकायत को सुनेगी। इसके पश्चात्, आपकी शिकायत सम्बन्धित जिले को निचले स्तर पर फॉरवर्ड कर दी जाएगी। जिसके बाद, जल्द से जल्द आपकी समस्या का समाधान किया जाएगा।

Ration Card List कैसे देखे?

हमारे आर्टिकल के माध्यम से बताई गई प्रक्रिया के द्वारा सभी नागरिक आसानी से Ration Card List में अपना नाम चेक कर सकते हैं

State Wise Ration Card List कैसे देखे?

हमारे आर्टिकल के माध्यम से बताई गई प्रक्रिया के द्वारा सभी नागरिक आसानी से Ration Card List में अपना नाम चेक कर सकते हैं

Latest Trending News In Hindi

अब 1 मिनट में जानें कि आप के आधार कार्ड से कितनी सिम ACTIVE हैं : आज जो जानकारियां हम आपको देने जा रहे हैं वह आपको काफी सहायता प्रदान करने वाली है क्योंकि आपको पता होना चाहिए कि आपका आधार कार्ड किस व्यक्ति ने यूज किया है और कौन व्यक्ति आपके आधार कार्ड के माध्यम से सिम प्रयोग में ला रहा है. अगर आप 1 मिनट में जाने की आप के आधार कार्ड के माध्यम से कितने सिम एक्टिव हैं तो इसके लिए आपको हमारा आर्टिकल अंत तक पढ़ना होगा। आगे पढ़ने के लिए – यहाँ क्लिक करें

कन्या सुमंगला योजना में बेटी को मिलेंगे ये सारे लाभ : जैसा कि आप सभी जानते हैं महिलाओं की सामाजिक सुरक्षा के लिए सरकार विभिन्न प्रकार की योजनाओं का संचालन करती रहती है, Kanya Sumangala Yojana भी उनमें से एक है. इस योजना के अंतर्गत कन्याओं के जन्म के बाद 6 किस्तों में आर्थिक सहायता दी जाती है। आगे पढ़ने के लिए – यहाँ क्लिक करें

अमरनाथ यात्रा 2023 कब शुरू होगी | अमरनाथ यात्रा रजिस्ट्रेशन कैसे करें : अमरनाथ यात्रा कब खुल रही है और इसकी बंद होने की तिथि कौन सी है आदि अगर आप Amarnath Yatra करना चाहते हैं तो आपके लिए हमारा आर्टिकल बहुत ही महत्वपूर्ण होने वाला है क्योंकि यहां पर आपको बाबा अमरनाथ बर्फानी का पूरा पैकेज पता चलेगा आप पता कर पाएंगे। इस साल अमरनाथ यात्रा 30 जून से शुरू होगी और 11 अगस्त को रक्षाबंधन पर खत्म होगी. आगे पढ़ने के लिए – यहाँ क्लिक करें

राशन कार्ड में घर बैठे बदलें अपना गलत मोबाइल नंबर : दोस्तों यदि आपका राशन कार्ड बना हुआ है और आप अपने राशन कार्ड में कुछ संशोधन कराना चाहते हैं तो आप इस प्रक्रिया को घर बैठे ही कर सकते हैं। यदि आपका रजिस्टर मोबाइल नंबर आपके राशन कार्ड में गलत दर्ज हो गया है तो अब आप बहुत ही आसानी से ration card mobile number change कर सकते हैं। आगे पढ़ने के लिए – यहाँ क्लिक करें

राशन कार्ड रिन्यू कैसे करें : आज हम आपको बताएंगे कि राशन कार्ड रिन्यू कैसे करें यदि आप अपने राशन कार्ड को भी नहीं कराते हैं तो आपके राशन कार्ड को डीएक्टिवेट कर दिया जाता है और आपको इस कारण राशन उपलब्ध नहीं कराया जाता है यदि आप भी अपने राशन कार्ड को नवीन राशन कार्ड में परिवर्तित करना चाहते हैं और उसका नवीनीकरण कराना चाहते हैं तो आप हमारे आर्टिकल को अवश्य पढ़ें। आगे पढ़ने के लिए – यहाँ क्लिक करें

कोटेदार के खिलाफ शिकायत कैसे करें : नमस्कार दोस्तों आज हम आपको बताएंगे कि आप उत्तर प्रदेश राज्य में ऑनलाइन माध्यम से कोटेदार के खिलाफ शिकायत कैसे करें दोस्तों यदि आपको कोटेदार से राशन वितरण या फिर अन्य और भी कोई समस्या है तो आप इसकी शिकायत संबंधित विभाग में ना जाकर ऑनलाइन माध्यम से आधिकारिक वेबसाइट के द्वारा कर सकते हैं. आगे पढ़ने के लिए – यहाँ क्लिक करें

UP Kisan Karj Rahat Yojana List : हेलो दोस्तों हमारे आर्टिकल में आपका बहुत-बहुत स्वागत है| आज हम बात करेंगे किसान ऋण मोचन योजना के बारे में | जो उत्तर प्रदेश से किसान भाई अपना नाम UP Kisan Karj Rahat List में देखना चाहते हैं वह इसकी ऑफिशल वेबसाइट पर जाकर देख सकते हैं | दोस्तों अपना ऋण माफ कराने के लिए जिन उत्तर प्रदेश के किसान भाइयों ने किसान कर्ज राहत योजना के अंतर्गत आवेदन किया है| वह किसान भाई अपना नाम किसान ऋण मोचन योजना सूची में जा सकते है| आगे पढ़ने के लिए – यहाँ क्लिक करें

fcs.up.gov.in 2022-2023 : यह यूपी सरकार द्वारा शुरू किया गया एक पोर्टल है। इस पोर्टल पर राशन कार्ड सम्बंधित सभी जानकारी उपलब्ध करायी जाती है। आप इसके माध्यम से अपनी श्रेणी के अनुसार राशन कार्ड के लिए आसानी से आवेदन कर सकते हैं व राशन कार्ड डाउनलोड, राशन कार्ड लिस्ट में नाम इत्यादि प्रक्रियाएं कर सकते हैं। आगे पढ़ने के लिए – यहाँ क्लिक करें

ग्राम पंचायत राशन कार्ड सूची 2022-2023 : दोस्तों आपको बता दें कि वर्ष 2022-2023 के लिए ग्राम पंचायत राशन कार्ड सूची को जारी कर दिया गया है। जो लोग ग्रामीण क्षेत्र से हैं वो अब इस लिस्ट में अपने नाम की जांच कर सकते हैं और राशन कार्ड के माध्यम से विभिन्न सुविधाओं का लाभ प्राप्त कर सकते हैं। आगे पढने के लिए – यहाँ क्लिक करें

शार्क टैंक इंडिया क्या है : हमारे देश में कई उभरते एंटरप्रेन्योर को बढ़ावा देने के लिए सोनी एंटरटेनमेंट टेलीविजन चैनल ने 20 दिसंबर को Shark Tank India शो शुरू किया है। यदि अपना छोटा सा बिजनेस शुरू करना चाहते हैं और एक एंटरप्रेनोर बनने के इच्छुक हैं तो आप सोनी एंटरटेनमेंट चैनल के इस शो को जरूर देखें। आगे पढने के लिए – यहाँ क्लिक करें

Akhiv Patrika | Property Mutation | How to Get Property Card Online : नगर निगम द्वारा प्रॉपर्टी टैक्स देने की प्रक्रिया को ठीक करने के लिए प्रॉपर्टी ओनरशिप ट्रांसफर का रिकॉर्ड अपने पास रखा जाता है। प्रॉपर्टी म्यूटेशन के माध्यम से ही यह पता चलता है कि संपत्ति एक शख्स से दूसरे को ट्रांसफर कर दी गई है। प्रॉपर्टी म्यूटेशन को अखिव पत्रिका भी कहते हैं। आगे पढने के लिए – यहाँ क्लिक करें

UP Ration Card Apply Online | UP APL, BPL Ration Card | fcs.up.gov.in | UP Ration Card NFSA | Ration Card UP | Ration Card Online UP | राशन कार्ड ऑनलाइन चेक up | यूपी राशन कार्ड ऑनलाइन | यूपी राशन कार्ड चेक कैसे करें | यूपी राशन कार्ड लिस्ट 2022 – 2023 | fcs.up.nic.in challan download | fcs up gov in | fcs up nic | fcs up ration card | Ration Card Check | Ration Card Download | Ration Card Online | Ration Card Online Apply | NFSA UP Ration Card